How To Get An Accurate Property Valuation

By McLennan Steege Smith Property Valuations|August 22, 2017

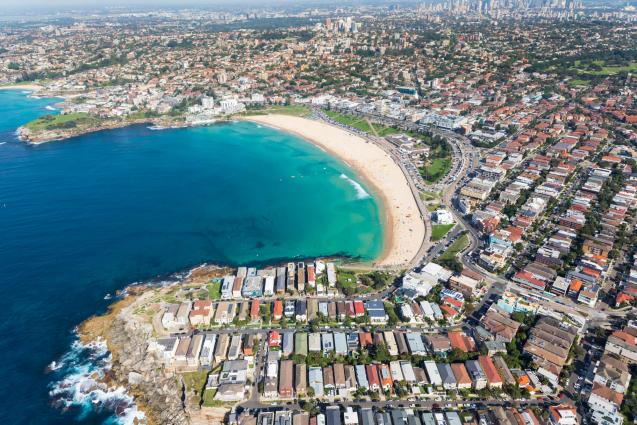

Current fair market value can be the best, or the worst, words you’ll hear a valuer utter. There is a reality to it, though. There’s a reason that during a real estate ‘bubble’, the tiniest, most outdated homes are selling for a small fortune whereas, during a time of no demand, the most beautifully appointed mansions are selling at bargain basement prices. When you have a choice, it’s never best to put your home up for sale during a market glut. It’s always best to sell when there is little inventory and lots of desire. Location matters, too. For many buyers, it matters more than almost anything.

Aside from these indisputable realities, here are some tips that can help you to arrive at the fairest and most accurate price point for your home.

Think Like a Buyer

When it comes time to sell your home, the most important thing you can do is to think like a buyer. Your personal décor means a lot to you. It’s your home, your space, and its warmth and meaningful clutter are precious to you, as they should be. A potential buyer, though, wants to visualise their own belongings there. Your home doesn’t have to be devoid of décor, but it should be limited. The overall aesthetic should be neat and organised.

This will raise the perception of your home’s value from the get go. It’s worth renting a storage space or pod for a few months while your home is showing. Removing rugs (if there’s wood underneath) and painting walls cream or white will instantly increase your home’s value. And don’t underestimate the appeal of fresh air. Odd smells, from cats to cooking to cigarettes, can be a turn off to many home buyers.

Be aware of kerb appeal. There’s no need to go over the top, but an attractive yard will appeal to potential buyers (and realtors) as they pull up to see your home. If your yard is a show piece, make sure that it’s trimmed and at its best. If it’s just a basic yard, make sure that it’s clear of clutter, and that it’s mowed and weeded.

Another element to a home's anticipated value will be based on how much potential updating to infrastructure will be needed and how much cosmetic work may be desired. The age, and stage, of your home, is a key factor in its value.

It might be wise to hire a vendor advocate to do a walk through before you seek a valuation. Vendor advocates are experts in identifying turn-ons and turn-offs in homes that are for sale. And, they’re on your side.

Comparable Property Prices

In terms of comparables, a home comes down to location, property acreage, square footage, the number of bedrooms – and, perhaps most important – the number and location of baths. Baths are a point of real value (or lack thereof) because home buyers these days are wise to the cost of installing or changing plumbing. In the property valuation process, a valuer will generally start by comparing your home, based on these elements, to similar homes in your location.

Who Should You Hire to Value Your Home’s Worth?

We advise that you seek multiple opinions as to what your home is worth. It can be quite interesting, discovering the range of estimates you’ll receive. Realesate.com.au cites an example where a house was valued by various real estate professionals – its potential selling price ranged from $520,000 to $670,000. The highest and lowest prices are probably not the most realistic. Though there are basic elements that all valuers will look at, personal opinion and taste do come into play when a property is valued. Don’t give away prior valuers’ estimates up front. Allow each person you hire to start his or her valuation from scratch.

It’s probably worth budgeting at least $1000-$1200 dollars toward valuations. Each valuation done by a licensed, independent property valuer should cost you about $500 – and it’s worth it. A realtor might overstate the value of your home because he or she would like to be the listing agent for it. It isn’t helpful or realistic for you to have your property value overestimated. A licensed, independent property valuer isn’t looking for a listing. They will employ their knowledge and expertise in valuing your home. This is what you want.

Do your own research, too. This will give you an opening to discuss and understand what a valuer feels your home is worth. When selling a home, there’s really no such thing as being over-informed.

McSSA provide independent property valuations in Sydney.

Aside from these indisputable realities, here are some tips that can help you to arrive at the fairest and most accurate price point for your home.

Think Like a Buyer

When it comes time to sell your home, the most important thing you can do is to think like a buyer. Your personal décor means a lot to you. It’s your home, your space, and its warmth and meaningful clutter are precious to you, as they should be. A potential buyer, though, wants to visualise their own belongings there. Your home doesn’t have to be devoid of décor, but it should be limited. The overall aesthetic should be neat and organised.

This will raise the perception of your home’s value from the get go. It’s worth renting a storage space or pod for a few months while your home is showing. Removing rugs (if there’s wood underneath) and painting walls cream or white will instantly increase your home’s value. And don’t underestimate the appeal of fresh air. Odd smells, from cats to cooking to cigarettes, can be a turn off to many home buyers.

Be aware of kerb appeal. There’s no need to go over the top, but an attractive yard will appeal to potential buyers (and realtors) as they pull up to see your home. If your yard is a show piece, make sure that it’s trimmed and at its best. If it’s just a basic yard, make sure that it’s clear of clutter, and that it’s mowed and weeded.

Another element to a home's anticipated value will be based on how much potential updating to infrastructure will be needed and how much cosmetic work may be desired. The age, and stage, of your home, is a key factor in its value.

It might be wise to hire a vendor advocate to do a walk through before you seek a valuation. Vendor advocates are experts in identifying turn-ons and turn-offs in homes that are for sale. And, they’re on your side.

Comparable Property Prices

In terms of comparables, a home comes down to location, property acreage, square footage, the number of bedrooms – and, perhaps most important – the number and location of baths. Baths are a point of real value (or lack thereof) because home buyers these days are wise to the cost of installing or changing plumbing. In the property valuation process, a valuer will generally start by comparing your home, based on these elements, to similar homes in your location.

Who Should You Hire to Value Your Home’s Worth?

We advise that you seek multiple opinions as to what your home is worth. It can be quite interesting, discovering the range of estimates you’ll receive. Realesate.com.au cites an example where a house was valued by various real estate professionals – its potential selling price ranged from $520,000 to $670,000. The highest and lowest prices are probably not the most realistic. Though there are basic elements that all valuers will look at, personal opinion and taste do come into play when a property is valued. Don’t give away prior valuers’ estimates up front. Allow each person you hire to start his or her valuation from scratch.

It’s probably worth budgeting at least $1000-$1200 dollars toward valuations. Each valuation done by a licensed, independent property valuer should cost you about $500 – and it’s worth it. A realtor might overstate the value of your home because he or she would like to be the listing agent for it. It isn’t helpful or realistic for you to have your property value overestimated. A licensed, independent property valuer isn’t looking for a listing. They will employ their knowledge and expertise in valuing your home. This is what you want.

Do your own research, too. This will give you an opening to discuss and understand what a valuer feels your home is worth. When selling a home, there’s really no such thing as being over-informed.

McSSA provide independent property valuations in Sydney.