Owner Builder Loans 2021: Things to Expect After Lodging Your Application

Often people applying for owner builder loans are only concerned about the needed preparations, such as sourcing a property/land and the potential build cost before placing their loan applications. But what happens after that if something is left unchecked, which sometimes can cause more problems if not inconveniences in securing finance?

Just a quick background, owner builder loans are specialised loans for owner-builders or licensed builders who want to build their own dwelling or investment property. As such, this loan product requires different sets of requirements and most lenders are cautious in approving applications.

Now that you have successfully lodged your application, what should you expect? Knowing these post-application steps is necessary in ensuring a seamless and stress-free borrowing and building.

Waiting for your loan approval

Once your offer has been accepted by the property owner or developer, you need to sign some paperwork and the property is nearly yours.

But just because you’ve had the bank’s preapproval doesn’t mean you just sit back and relax. There are still things that need to be done.

ALSO READ: Bad Credit Home Loans: Relevant Updates in 2021

The bank will still have to send a valuer to check whether everything’s right and they also want to make sure that you’re not ripping them off. They achieve this by analysing the costs you have provided via quotes, checking the supervisors credentials and checking to see if your timelines to complete are realistic. This is one of the unique things about owner-builder loans--lenders are particularly strict in approving applications.

Once the inspections and valuation are done, some more paperwork is needed to be signed.

Pre-settlement

Once your loan application has been approved, there are still more documents that you need to sign and submit.

You will also be required to pay for the last deposit--the amount varies from case to case. Factors such as the loaned amount, your deposit, and cash rate, may be taken into account in computing for your last deposit.

Once everything has been settled and documents needed have been complied with, you may finally get your start date. This will mean you can settle on the land or subject property and begin organizing professionals/consultants and contractors and paying deposits to begin work.

Managing the Build

During this build time you will need alternative accommodation-many stay with relatives to save money where possible. Also, it pays to not be too far from the build site so regular inspections and managing the build is possible. Some renovations can be quick e.g. several months while other complete house builds can take anywhere up to 18 months. So project management and budgeting skills can prove very useful

Moving in to your new home

Once needed documents have been filled out and checks are done and the local council has issued a certificate of occupancy or similar then you are legally allowed to live in the home.

Considering country-wide restrictions due to Covid-19 pandemic, some states and territories may impose a moving-in moratorium so make sure you establish contact with your local council to avoid any inconveniences.

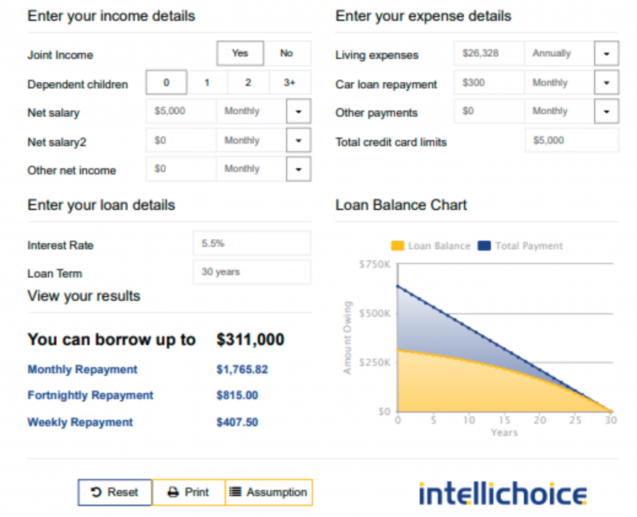

Darin Hindmarsh is the founder and CEO of Intellichoice Finance, a broking firm based in Brisbane, where he specialises in owner builder loans. He's been providing financial and broking services in the past 18 years. Hindmarsh is also finalist in the 2020 Australian Mortgage Awards - Pepper Money Broker of the Year – Specialist Lending. To jumpstart your home loan application, visit their home loan online application page today. Like and follow them on their Twitter and Facebook accounts. ???

Just a quick background, owner builder loans are specialised loans for owner-builders or licensed builders who want to build their own dwelling or investment property. As such, this loan product requires different sets of requirements and most lenders are cautious in approving applications.

Now that you have successfully lodged your application, what should you expect? Knowing these post-application steps is necessary in ensuring a seamless and stress-free borrowing and building.

Waiting for your loan approval

Once your offer has been accepted by the property owner or developer, you need to sign some paperwork and the property is nearly yours.

But just because you’ve had the bank’s preapproval doesn’t mean you just sit back and relax. There are still things that need to be done.

ALSO READ: Bad Credit Home Loans: Relevant Updates in 2021

The bank will still have to send a valuer to check whether everything’s right and they also want to make sure that you’re not ripping them off. They achieve this by analysing the costs you have provided via quotes, checking the supervisors credentials and checking to see if your timelines to complete are realistic. This is one of the unique things about owner-builder loans--lenders are particularly strict in approving applications.

Once the inspections and valuation are done, some more paperwork is needed to be signed.

Pre-settlement

Once your loan application has been approved, there are still more documents that you need to sign and submit.

You will also be required to pay for the last deposit--the amount varies from case to case. Factors such as the loaned amount, your deposit, and cash rate, may be taken into account in computing for your last deposit.

Once everything has been settled and documents needed have been complied with, you may finally get your start date. This will mean you can settle on the land or subject property and begin organizing professionals/consultants and contractors and paying deposits to begin work.

Managing the Build

During this build time you will need alternative accommodation-many stay with relatives to save money where possible. Also, it pays to not be too far from the build site so regular inspections and managing the build is possible. Some renovations can be quick e.g. several months while other complete house builds can take anywhere up to 18 months. So project management and budgeting skills can prove very useful

Moving in to your new home

Once needed documents have been filled out and checks are done and the local council has issued a certificate of occupancy or similar then you are legally allowed to live in the home.

Considering country-wide restrictions due to Covid-19 pandemic, some states and territories may impose a moving-in moratorium so make sure you establish contact with your local council to avoid any inconveniences.

Darin Hindmarsh is the founder and CEO of Intellichoice Finance, a broking firm based in Brisbane, where he specialises in owner builder loans. He's been providing financial and broking services in the past 18 years. Hindmarsh is also finalist in the 2020 Australian Mortgage Awards - Pepper Money Broker of the Year – Specialist Lending. To jumpstart your home loan application, visit their home loan online application page today. Like and follow them on their Twitter and Facebook accounts. ???